[email protected]

| We established a quick response research team to monitor the impacts of global pandemic COVID19 on this market to keep our clients informed about latest data and changing strategies. The report will incorporate these insight and data factors. | × |

|---|

COVID-19 Impact Analysis

Understand the COVID-19 Outbreak and its impact on global & regional businesses

request free proposalCOVID-19 Insights

Insights on a world turned upside down : Re-imagining

The post-COVID19 Business resilience & recovery

Strategy Time

How effective strategies and business recovery plans are winning the race

request free proposalResponding to COVID-19

Goldstein Market Intelligence help you navigate through the COVID-19 crisis,

we will provide you most relevant market insights on crisis management,

recovery strategy & business continuity.

Australia Soft Drink Market Size, Trends, Share, Industry Analysis, Demand & Growth Opportunity Assessment, Regional Outlook, & Forecast 2017-2025

2019-08-19

210

PDF/PPT/XLS/Hard Copy

Australia

Market Outlook

Soft drinks have been consumer’s prime choice, which can be consumed anytime and anywhere. Soft drinks include all kind of water based drinks that includes additives such as sugar and sugar substitutes, aromas and minerals. Two major players of carbonated soft drinks, PepsiCo and Coca-Cola has extensive distribution channel that has catered every segment of Australia population. In 2017, on average revenue per capita in Australia soft drinks market amounted to USD 190.9 and average volume per capita was 129.16 liter. Australia accounts for soft drinks manufacturing plants of global players such as PepsiCo and also some local players such as Berts Soft Drinks, which have positively impacted the distribution channel. There have been concerns over sugar and calorie content in soft drinks, but over a period of time, developments has resolved the issue by manufacturing of sugar free and zero calorie soft drinks, which is majorly preferred by diabetic and other health conscious consumers.

Goldstein Research analyst forecast that the Australia soft drinks market size is set to reach USD 5,813 million by 2025, growing at a CAGR of 3.4% over the forecast period. The rising population, per capita consumer spending, Australia’s GDP, developments in flavors and packaging among others boost the growth of the Australia soft drinks market.

Australia Soft Drinks Market Segmentation

By Soft Drinks Type

- Carbonated Soft Drinks

- Cola Drinks

- Energy Drinks

- Non-Carbonated Soft Drinks

- Lemonade

- Fruit Juices

- Flavored Mineral Water

- Other Instant Beverages (Coffee-based drinks)

By Packaging

- PET/Plastic

- Metal can

- Tetra packs

- Glass

- Other (Dispense etc.)

By Trade

- On-Trade (Bars, Restaurants, etc.)

- Off-Trade (in stores)

By Distribution Channel

- Online

- Offline

Based on Geography

- New South Wales Soft Drinks Market {Market Share (%), Market Size (USD Billion)}

- Victoria Soft Drinks Market {Market Share (%), Market Size (USD Billion)}

- Queensland Soft Drinks Market {Market Share (%), Market Size (USD Billion)}

- South Australia Soft Drinks Market {Market Share (%), Market Size (USD Billion)}

- Western Australia Soft Drinks Market {Market Share (%), Market Size (USD Billion)}

- Tasmania Soft Drinks Market {Market Share (%), Market Size (USD Billion)}

- Northern Territory Soft Drinks Market {Market Share (%), Market Size (USD Billion)}

Product & Region with Major Market Share

On the basis of soft drinks type, carbonated drinks accounted for largest market share of 43.1% in 2017 of total Australia soft drinks market. The rising health concerns are inducing the growth of non-carbonated soft drinks, which declined the carbonated soft drinks market by 4% in 2017. In near future, non-carbonated drinks are expected to take over the carbonated drinks market share, with major contribution from the fruit juices. Fruit Juices market is growing at a rate of 3.1% annually, where major players have shifted their focus towards manufacturing of fruit juices.

Based on geography, New South Wales accounted for largest market share of 23.4% in 2017, as this region holds top developed cities, where the consumption of soft drinks is has highest share. This is followed by Victoria, Western Australia and Queensland. Smaller states such as South Australia, Tasmania, Northern territory has low market share, but they are expected to grow at a rate of 3.0% annually on back of strengthening distribution channel and rising per capita income of people.

Market Dynamics- Trends, Drivers and Challenges

The growing numbers of breweries such as Batch Craft Soda, Stubborn Soda, Virgil's, Bruce Cost Ginger Ale, have entered into supply of craft soda and craft soft drinks in different flavors like black cherry, pineapple, orange and others. The trend of establishing crafts is extended by the big soft drinks manufacturers such as PepsiCo and Mountain Dew. PepsiCo has entered into breweries under the name of Stubborn Soda.

The development in the soft drinks to acknowledge the rising health concerns among the consumers is driving the growth of Australia soft drinks market. Advancements such as sugar free soft drinks, quality check labels, including fruit pulps in the drinks and others have increased consumers spending on soft drinks. Soft drinks manufacturers have therefore reduced sugar contribution by 26%.

Government legislations impose challenges to the soft drinks manufacturers such as government has imposed container deposit legislation (CDL) in Australian states of New South Wales, South Australia and Northern Territory, with a viewpoint of reducing wastes and recyclability. Though this tax has to be paid by manufacturers but its cost has been passed onto consumers.

Covered in this Australia Soft Drinks Market Report

The report covers the present ground scenario and the future growth prospects of the soft drinks market for 2017-2025 along with the sales and revenue of the soft drinks. We calculated the market size and revenue share on the basis of revenue generated from major players across the globe. We have forecast the market on the basis of number of manufacturers, suppliers and distributors, per unit price, volume consumption and food processing companies.

Australian Soft drinks market report 2017-2025, has been prepared based on an in-depth market analysis from industry experts. The report covers the competitive landscape and current position of major players in the soft drinks market. It also includes porter’s five force model, SWOT analysis, company profiling, business strategies of market players and their business models. Australia soft drinks market report also recognizes value chain analysis to understand the cost differentiation to provide competitive advantage to the existing and new entry players.

Companies analyzed as key palyers in soft drink market: Coca-Cola, PepsiCo, Nestle, Berts Soft Drinks, Asahi Beverages, Bickfords Australia Pty Ltd, Carabao Energy, Frezco Beverages Ltd, Grove Fruit Juice Pty Ltd, Kraft Heinz Company, Mildura Fruit Juices Australia Pty Ltd.

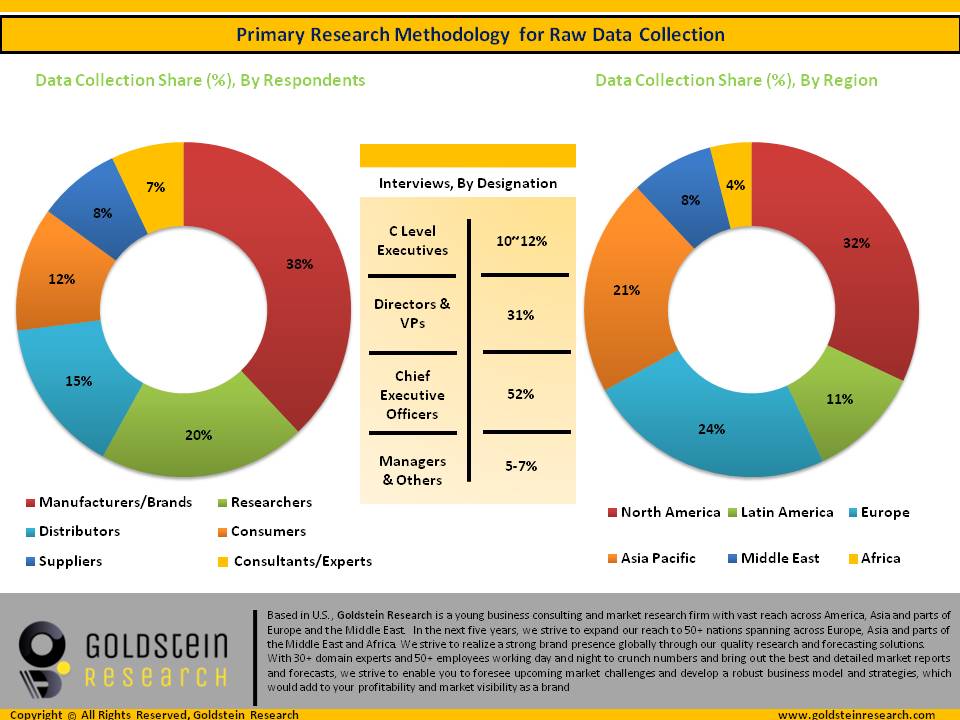

The study was conducted using an objective combination of primary and secondary information including inputs from key participants in the industry. The report contains a comprehensive market and vendor landscape in addition to a SWOT analysis of the key vendors.

Key questions answered in this Australia Soft Drinks Market Report

- What is the total market size by 2025 and what would be the expected growth rate?

- What is the revenue of soft drinks market in 2016-17 and what would be the expected demand over the forecasted period?

- What are the key market trends?

- What are the factors which are driving this market?

- What are the major barriers to market growth?

- Who all are the key vendors in this market space?

- What are the market opportunities for the existing and entry level players?

- What are the recent developments and business strategy of the key players?

We can provide two hour complimentary interaction with our analyst after the purchase of this market report. Details are imparted within the report.

A complementary 2hrs free facility through which report buyers can interact with our pool of experienced analysts for any report related queries, clarifications or additional data requirements

OR Call Us:+1-646-568-7747Table of Contents

BROWSE SIMILAR REPORTS

-

Fruit Juice Market - Industry Scope, Demand, Size, Revenue, ScopeSegmentation ( By Product, By Concentration, Packaging Type, By Distribution Channel), Forecast Period 2016-2024

-

Global Flavored Milk Market Outlook 2024: Global Opportunity and Demand Analysis, Market Forecast, 2016-2024

-

Global Mango Juice Market Outlook 2024: Global Opportunity and Demand Analysis, Market Forecast, 2016-2024

-

Australia Bottled Water Market Size, Share, Trends, Demand, Growth Opportunity , By Product, By Packaging , By Distribution Channel & by Region with Forecast 2017-2030

-

Australia Fruit Juice Market Size, Trends, Share, Industry Analysis, Demand & Growth Opportunity Assessment, Regional Outlook, & Forecast 2017-2025

-

Australia Carbonated Water Market Analysis by Flavor (Cola, Lime, Orange ,Others), by distribution channel & by packaging type (Pet Bottles & Pet Cans) -Forecast to 2025